The “big beautiful bill” or variously the “xz&#ing bill”, whatever you want to call it, is basically a tax cut for the wealthy and large corporations. It does truly put ‘pedal to the metal’ relative to wealth inequality in America. A major problem for non-wealthy Americans and for both the short and long-term financial risk to the country.

I have written often in this space about the danger of American and global wealth inequality. Here and here and here. All three columns have multiple charts, mostly from the deepest thinker today on wealth inequality, Thomas Piketty .

During the 20 years I have been a professional futurist, I have suggested that, along with the climate crisis and the explosive growth of AI, the greatest wealth inequality [globally and nationally] in the last 100 years is a massive global problem that needs to be addressed. It is one of the reasons that I have long stated that both Democracy and Capitalism need to be reinvented and updated from when they both came into existence in the 1700s.

History, and suggestions from deep thinkers such as Piketty, all point to the need for a progressive income tax. The bill that Trump just signed into law is the exact opposite from what is needed. Here is a chart from Piketty that was in a couple of the above linked columns.

You can see that the highest level of wealth held by the top 0.1% of America was in 1913. It then took a huge drop, only recovering during the “roaring 20’s” up until the 1929 stock market crash. What happened in 1913 was the introduction of the first federal income tax.

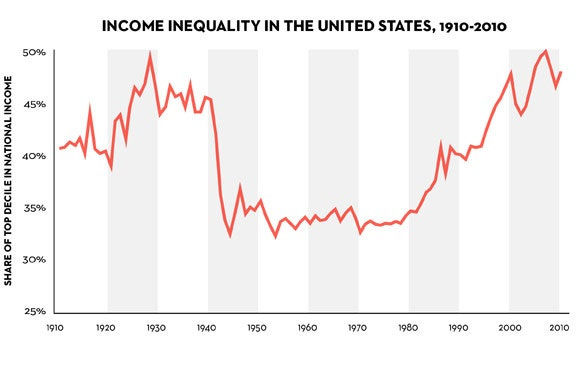

Here is another chart that shows the top 10% and the share of American wealth. Again we see the profound effects of the initial 1913 income tax, WWII and the upward trajectory of the very wealthy since the 1980s.

We can see the effects on wealth inequality from the initial income tax of 1913, the escalation of taxes to fund WWII and then the decades from the mid-1940s to the mid-1980s when progressive tax rates were in place.

The very few times I have asked a Make America Great Again person about the “again” part of the slogan, the answer has been stuff like “the decades after we won WWII”. “the 1950s” or “the 1950s through the 1970s”

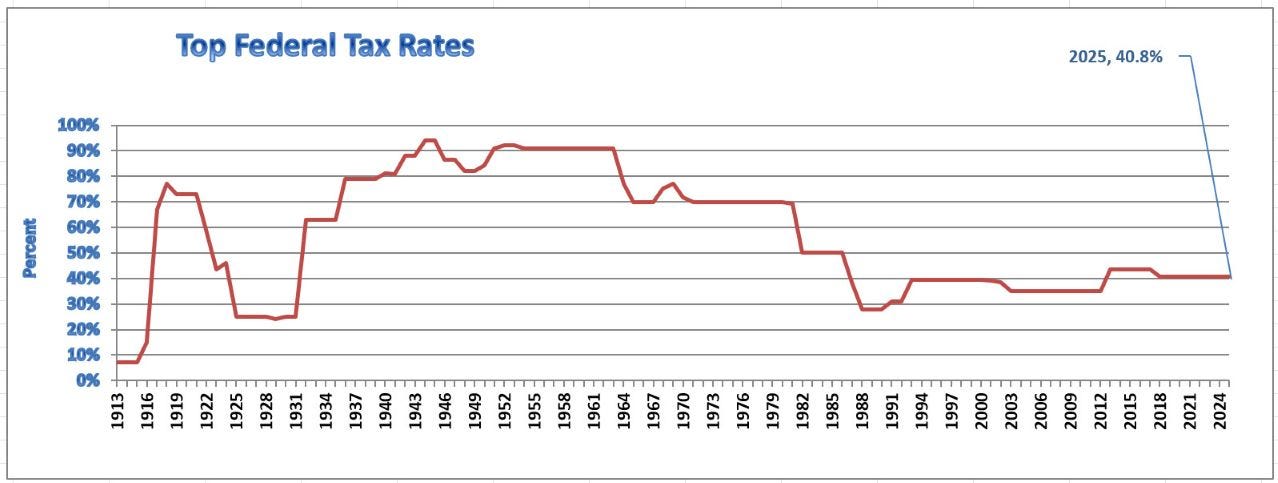

Here is a chart with the top marginal tax rates in the U.S. for the last 100 years

Well, if we want America to be great again as it was in the post-WWII era, shouldn’t we look to the tax rates when “we were great” and the top rate was 90% and now it is 40%, less than half. Greatness in government needs funding.

In post-WWII decades, with the 90% top bracket, the CFO met with the CEO in the fourth quarter to decide what to do with cash flow and profits. If the gross taxable profit was $10 million [in 1955 dollars, $120 million in 2025 dollars] the CFO might have said to the CEO that they have a choice. They can pay the 90% tax on the $10 million or they can reinvest it in the business, to build a new factory or buy another, smaller business. The choice was obvious. Investments were made. And America ruled the world.

So making the tax code far more progressive – increasing the rates for those that make over $10 million a year to 70% or above- will successfully address the destructive wealth inequality. It might also “Make America Great Again” if history is a guide.

The other thing about this tax cut for the wealthy is the squandering of opportunity. It is estimated by the Institute on Taxation and Economic Policy that, over the next 10 years the wealthiest individuals and most large corporations will receive $1 Trillion in lowered taxes. Of that it is estimated that in 2026 alone the wealthy will have tax cuts totally $117 billion. So, before the 2026 mid-terms the wealthy will receive this amount of lowered taxes.

Compare that to the fact that the bill cuts to Medicaid over the next decade total $930 billion [per the above linked article from the ITEP]. These cuts become effective in 2027, after the mid-terms. So the lower class, the lower middle class, the middle class – recipients of Medicaid -will not know whether and by how much these cuts in the bill, will affect them until after the mid-terms. Give billions to the rich before and after elections and pay for this with reduced safety-net benefits for the poor that take effect after the elections.

Simply stated, this tax cut bill will only dramatically increase the problem of wealth inequality.

Short and Long Term Damage to the United States

The known damage will be to the fabric of society as wealth inequality increases. The projected damage to the fiscal stability of the U.S. government is massive. It is projected that this tax bill will add between $3.1-3.5 trillion to the U.S. deficit over the next decade.

The estimate from the Social Security Administration itself suggests that, with the current Social Security plan in place, there will be, long-term over the coming decades an annual shortfall of $332 billion. The tax cut for the wealthy could have significantly been used to shore up Social Security so that it will last past 2034

There is no other way to say this, but the new tax bill:

-gives billions to the wealthy, increasing wealth inequality

-takes medical benefits from the lower classes to pay for the tax cuts, which will increase wealth inequality

-will add to the deficit and will ultimately cripple the country’s ability to do much in the future except for servicing the debt.

So, on this July 4th holiday we have immeasurably increased the wealth inequality of the country, put sizeable portions of the lower classes at risk, and threatened the long-term financial stability of the country.

I do not think this is good. Do you?

Yes, generally the pendulum swings through America's history.

These United States are currently experiencing a "Difficult Moment in Time".....Hopefully the Political Environment will move in some very different directions soon..